ILLUSTRATIVE FINANCIAL STATEMENT

To illustrative the calculation of ratio, the following statement of financial position and statement of profit or lost figures will be used. we are using a separate statement of profit or lost for this example, as no items of other comprehensive income are involved.

PROFITABILITY RATIO

In our example, the company made a profit in both 2021 and 2020, and there was an increase in profit between one year and the next:

(a) of 52% before taxation

(b) of 39% after taxation

Profit before taxation is generally thought to be a better figure to use than profit after taxation. Because there might be unusual variation in the tax charge from year to year which would not affect the underlying profitability of the company's operations.

Another profit figure that should be calculate is profit before interest and tax (PBIT) This is the amount of profit that the company earned before having to pay interest to the providers of loan capital, such as loan notes and medium term bank loans, which will be shown in the statement of financial position as non current liabilities. It is therefore calculate as profit before tax plus interest charge on long term finance.

.

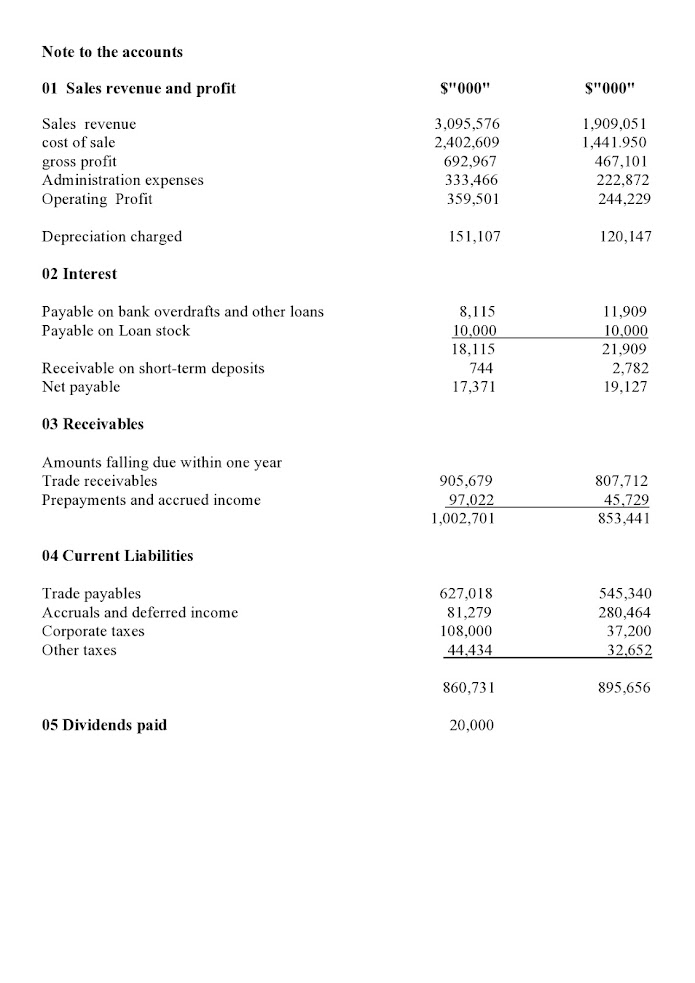

Published account do not always give sufficient details on interest payable to determine how much is interest on long term finance . Will be assume in our example that the whole of the interest payable ($ 18,115,000-note 02) relates to Long term finance.

PBIT in our example is therefore

This shows a 46% growth between 2020 and 2021

Return on capital employed(ROCE)

It is impossible to assess profit or profit growth properly without relating them to the amount of funds (capital) that were employed in making the profits. the most important profitability ratio is therefore return on capital employed (ROCE). Which states the profit as a percentage of the amount of capital employed.

ROCE = (Profit before interest and taxation / (total assets- current liabilities))100%

Capital employed = Shareholder's equity + non current liabilities

OR

Total assets - current liabilities

The underlying principle is that we must compare like with like, and so if capital means

(Share capital and reserves + non current liabilities and debtor capital)

Profit must mean the profit earned by all this capital together this is PBIT , since interest is the return for loan capital.

In our example, capital employed is:

2021 $ 1,870,630 - $ 860,731 =$ 1,009,899

2020 $ 1,664,425 - $ 895,656 =$ 768,769

The total are the total assets less current liabilities figures 2021 and 2020 in the statement of financial

position

ROCE 2021 _ $ 360,245 / $ 1,009,899 = 35.7 %

2020 _ $ 247,011 / $ 768,769 = 32.1%

What does a company's ROCE tell us ? in effect, a ROCE of 35.7% means that for every $ 100 of capital invested in the company ,management create $ 35.7 of profits therefore, ROCE is a measure to assess how well capital is used to generate profit.

what should we be looking for ? there are three comparison that can be made.

(a) The change in ROSCE from one year to the next can be examined . in this example there has been an increase in ROCE by about four percentage points from 2020level

(b) The ROCE being earned by other companies , if this information in available, can be compared with the ROCE of this company. Here the information is not available.

(c) A comparison of the ROCE with current market borrowing rates may be made

(01) What would be the cost of extra borrowing to the company if it needed more loans, and is it earning a ROCE that suggests it could make profits to make such borrowing worthwhile?

(02) Is the company making a ROCE that it is getting value for money from its current borrowings?

In this example , if we suppose that current market interest rates, say , for medium -term borrowing from banks , are around 10% then the company's actual ROCE of 36% in 2021 would not seem law. on the country , it might seem high.

However it is easier to spot a law ROCE than a high one, because there is always a chance that the company's non current assets, especially property, are undervalued in its statement of financial position, and so the capital employed figure might be unrealistically law. if the company had earned a ROCE , not of 36%, but of , say only 6% then its return would have been bellow current borrowing rates and so disappointingly low.

Return on equity

Return on equity(ROI) gives a more restricted view of capital than ROCE , but it is based onthe same principles.

ROE = (Profit after tax and preference dividend / Equity share holder's fund )x100%

In our example ,ROE is calculated as follows

ROE 2021 _ $ 267,930 / $909,899 =29.4%

ROE 2020 _ $ 193,830 / $ 668,769 = 29%

ROE is not widely -used ratio, however, because there are more useful ratios that give an indication of the return to share holders, such as earning per share, dividend per share, dividend yield and earning yield, which are described later .

Analyzing profitability and return in more details: secondary ratio

we often sub analyze ROCE , to find out more about why the ROCE is high or low or better or worse than last year. there are two factors that contribute towards a return on capital employed. Both related to sale revenue

(A) Profit margin . A company might makes a high or low profit margin on its sales. for example,a company that makes a profit of $ 25 per $ 100 of sales is making a bigger return on its revenue than another company making a profit of only $ 110 per $ 100 of sales

(B) Assets turnover .Assets turnover is measure of how well the assets of a business are being used to generate sales. For example ,

if two companies each have capital employed of $100m and company A makes sales of $400m per annum whereas company B makes sales of only $ 200m per annum,, company A making a higher revenue from the same amount of assets(twice as much asset turnover as company B) and this will help A to make a higher return on capital employed than B. Asset turnover is expressed as "x times" so that assets generate x times their value in annual sales here, company A's assets turnover is 4 times and B's is 2 times .

Profit margin and asset turnover together explain the ROCE and if the ROCE is the primary profitability ratio ,these other two are the secondary ratios .

In this example, the company's improvement in ROCE between 2020 and 2021 is attributable to a higher asset turnover. indeed the profit margin has fallen a little, but the higher asset turnover has more than compensated for this

it is also worth commenting on the change in sales revenue from one year to the next . $1,900 m to $ 3,100 m between 2020 and 2021. this is very strong growth, and this is certainly one of the most significant term in the statements profit loss and statement of financial position.

THANK YOU.

Next article topic- briefly explanation of solvency ratio and gearing ratio analysis with examples

Presenting by -Accounting way

for more information -

follow "accounting way" official face book account

subscribe and click the bell icon, to "Accounting tutorials" YouTube channel for practicing knowledge

YouTube channel link mentioned below

https://www.youtube.com/channel/UCpe3Z6l310iM4RcZO1-2mlw

No comments:

Post a Comment